Market moves across the month were to the south. Fixed income markets seemed to have a more drastic message on the monitor than that of equities.

Fixed Income: 2-Yr Treas Yield 4.16% | 10-Yr Treas. Yield 4.28%

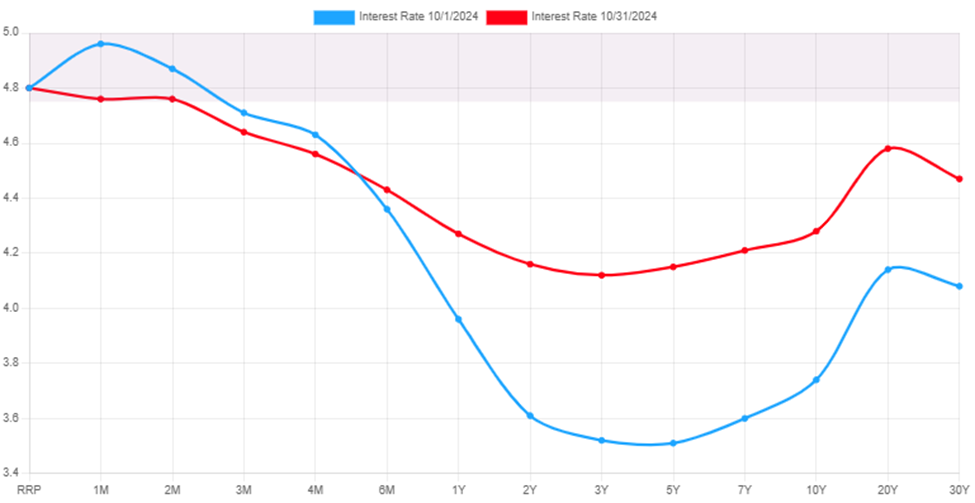

Bond markets went for a reversal ride in October. After several months of falling rates, we began to see a pullback in the bond market as interest rates rose. The 2-year treasury rose 0.55%, while the 10-year treasury rose 0.54%. The good news is that while rising, the rates did not invert again. The long picture remains intact. We are still in an elevated rate environment with them more likely to drift south rather than north. This move may have been the result of predictions for a potential structure that would mean tariffs. This would reflect a higher inflation potential which would signal a slower path in future rate cuts. Additional good news is that while rates from 6 months on rose, shorter duration rates continued to fall. This bodes well for the normalization of the entire curve.

Equities: Dow Jones 1.34% | S&P 500 0.99% | NASDAQ 0.52%

While it was a down month for equites, the overall move south was not bad for the month. From the top of the market for the S&P 500 (10/18/2024) to the end of the month logged a 2.83%. This proved to be a mild lead up to the beginning of November. The nice part is that while a correction has not materialized, earnings season did, bringing the P/E ratio for the S&P 500 back down to 21.19.

Throughout the month utility stock did well until the last week of the month. A shifting towards Financial and consumer discretionary was underway. Neither of which are surprising given interest rates (favoring financials) and the fact that we are in the fourth quarter… I like to say, ‘Americans spend money they do not have on things they do not need’, AKA: holiday season!

Conclusion

Equities pulled back less than was indicative of the rate move on the bond market. The move there signaled more concern about higher rates for longer than equities chose to price in. The shift in rates seemed like a long-term change in projection, while short rates seemed anchored to FRB actions. The longer rage rates often can be equated to long range GDP expectations. If the view is that we would have stronger forward GDP in 5 years, then we see a stronger 5-year rate.

A Look Ahead…

Market responses in October could have been far more drastic than they were. We should feel fortunate that we got the October that we did. This still leaves a correction (a market fall of 10% to 19%) unattended to. The last one ended 10/27/2023. While stretched P/E’s from over the summer have become more reasonable, that’s been due to strong earnings. Those may continue in the short run, but moving into 2025 those might be harder to come by. It may very well cause a correction in the first half of the year.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.

In many ways, 2021 felt like two years in one. Investing was no exception. Here is a review of the year from our perspective at FFS and what we are looking for from 2022.

Q1 2021

GameStop stole the show early in the year. In an anomaly, a group of Reddit traders took a reasonably good January (up about 3%) and wreaked havoc. The trade was clever, but greed eventually collapsed the trade and caused January to be a down month.

Mass roll out of vaccines dominated the headlines early in the year. People became excited on the hope of a return to normal life. This led to an expectation from investors that GDP was going to grow substantially in 2021. The thought was, as we got back out and spent money, the economy would boom. This led to what was affectionately referred to as the “re-opening” trade.

Q2 2021

The re-opening trade led to concerns about inflation increasing at a fever pitch, at least for a short while. The key term used by the Federal Reserve Board (FRB) repeatedly was transitory… Inflation rose 0.8%, 0.6%, and 0.9% across the quarter and 5.4% YoY through June.

The second quarter also gave us the Delta variant, which proved more virulent than earlier versions of COVID. The onset of Delta put a dampener on the expected re-opening boom over the summer. In effect, this held high inflation at bay… a little.

Q3 2021

As Delta occurrences faded after a few months, focus shifted sharply to supply line disruptions. The Bay of L.A. saw a point where around 86 freighters were anchored in bay waiting to be unloaded. The disruption caused what was expected to be transitory inflation to become more persistent.

September was a busy month for investors. A crisis in Evergrande debt, China’s energy demand, and debt ceiling debates gave reason for pause on equity markets. The S&P 500 fell by as much as 6% intra-month, which was the largest fall for the year.

Q4 2021

Fourth quarter is usually a quarter for growth as the consumer generally has a strong showing, courtesy of the holidays. October saw a market surge as the debt ceiling debate was pushed off to December. Helping matters were corporate earnings from Q3 that largely surpassing estimates.

Jobs perpetually improved across the year and inflation was firming. In response, the FRB decided to start cutting back on the amount of bonds they were buying. Rather than running in fear, the markets applauded the move (by increasing). It was viewed as the FRB avoiding the mis-step of waiting too long to act.

What would be a quarter without COVID, right? Thanksgiving Day the WHO announced a new variant out of Southern Africa named Omicron. This announcement killed any growth seen in November. As December unfolded the news coming out about Omicron was fairly positive. Yes, it was more infectious, but its symptoms appeared to be milder. As a result, there was less fear that Omicron would cause full blown shutdowns and markets regained composure.

2021 Summary

2021 proved to be a profitable year. It represented the first calendar year post recession. Historically year 2 (2022) is a good year as well, but there is a likelihood of diminished returns from 2021. Additionally, 2021 proved to have very low volatility. Something that is likely not to be repeated in 2022.

2022 Landscape

Inflation has persisted, but Q1 should calm down as consumers are historically dormant this time of year. Additionally, the reduced consumption will likely help the supply bottlenecks get cleared up. Yes, the bay of L.A. is still backed up.

Full employment is likely already upon us. December unemployment hit 3.9%. A level historically seen as “full” employment. This means rate hikes are not only a consideration, but a likelihood starting as soon as March. The FRB wants to get ahead of inflation, and they cannot do that without removing accommodation. Additionally, full employment gives them the freedom to focus on inflation.

This environment of FRB rate hikes will likely lend to heightened volatility throughout the year. The lack of a correction last year could mean one early this year. This would allow focus to shift to a strong earnings year and as a result, a strong stock year.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.