12|09|2025

Fed Decision in Focus | December 5, 2025

It was all about the economy this last week. That really means the Fed decision on December 10th was in focus. Monday S&P 500 0.53% | NASDAQ 0.38% US...

12|09|2025

It was all about the economy this last week. That really means the Fed decision on December 10th was in focus. Monday S&P 500 0.53% | NASDAQ 0.38% US...

12|02|2025

November trading concluded at the end of a Holiday-shortened week for markets. Will holiday cheer propel markets higher in December? Monday S&P 500 1.55% | NASDAQ 2.69% Markets soared...

11|26|2025

Corporate earnings season is coming to a close. Will there be enough fuel left in the tank for equities? Monday S&P 500 0.92% | NASDAQ 0.84% Markets sunk to...

11|18|2025

The week started hot but ended mixed. Will markets buck the seasonal trend this year? Monday S&P 500 1.54% | NASDAQ 2.27% Monday provided little economic data as attention...

11|11|2025

Markets fell as big earnings reports hinted at an overvalued equity market. Was this week a reminder to not have all your eggs in one basket? Monday S&P 500...

11|04|2025

Private sector data is guiding markets higher for now. Will markets have sufficient data for more gains as economic forecasts remain cloudy? Monday S&P 500 1.23% | NASDAQ 1.86%...

10|28|2025

Markets moved higher this week as they lean into earnings season. Will equities win out as markets continue to balance the risks? Monday S&P 500 1.07% | NASDAQ 1.37%...

10|21|2025

Tensions subsided on the world stage this week but there was plenty of news to review close to home. Will strong corporate earnings and a rate cut stabilize markets...

10|14|2025

Markets dropped this week in dramatic fashion. Will corporate earnings season allow markets to finish the year strong? Monday S&P 500 0.36% | NASDAQ 0.71% The week started off...

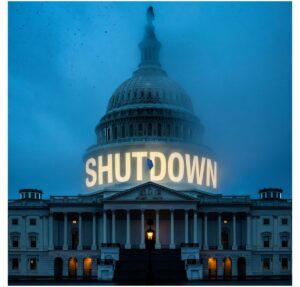

10|07|2025

The government shut down this week. Even with the lack of an agreement, is the private sector poised to remain open for business? Monday S&P 500 0.26% | NASDAQ...