02|17|2026

Tough Love | Market Thoughts | Feb. 13, 2026

This week was a lot of tough love for the technology sector. Will gains continue to be made elsewhere? Monday S&P 500 0.47% | NASDAQ 0.90% Momentum built to...

02|17|2026

This week was a lot of tough love for the technology sector. Will gains continue to be made elsewhere? Monday S&P 500 0.47% | NASDAQ 0.90% Momentum built to...

02|10|2026

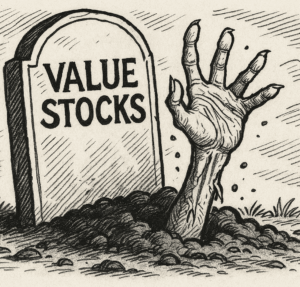

A rollercoaster week for equities but volatility did fade. Will leadership continue in value stocks as growth is under the microscope? Monday S&P 500 0.54% | NASDAQ 0.56% The...

02|06|2026

Markets were little changed last month. But a quick look at the monitor shows us that there may be a changing of the guard… Fixed Income: 2-Yr Treas Yield...

02|03|2026

January had its volatile moments, but all major equity indexes ended in the positive. Will the January Barometer be a reliable measure of success for the year? Monday S&P...

01|08|2026

The month of December came and went without markets moving much. Does this signal anything specific for 2026? We are monitoring the situation, see our thoughts below. Fixed Income:...

12|17|2025

The Federal Reserve cut rates 3 times in 2025. More rate cuts are going to happen, but less are forecasted in 2026. Monday S&P 500 0.35% | NASDAQ 0.14%...

12|03|2025

Markets were moving and shaking, but the monitor looks boring when you look at the month-over-month numbers. What really went on??? Fixed Income: 2-Yr Treas Yield 3.47% | 10-Yr...

11|26|2025

Corporate earnings season is coming to a close. Will there be enough fuel left in the tank for equities? Monday S&P 500 0.92% | NASDAQ 0.84% Markets sunk to...

11|18|2025

The week started hot but ended mixed. Will markets buck the seasonal trend this year? Monday S&P 500 1.54% | NASDAQ 2.27% Monday provided little economic data as attention...

11|11|2025

Markets fell as big earnings reports hinted at an overvalued equity market. Was this week a reminder to not have all your eggs in one basket? Monday S&P 500...