Market moves across the month were to the south. Fixed income markets seemed to have a more drastic message on the monitor than that of equities.

Fixed Income: 2-Yr Treas Yield 4.16% | 10-Yr Treas. Yield 4.28%

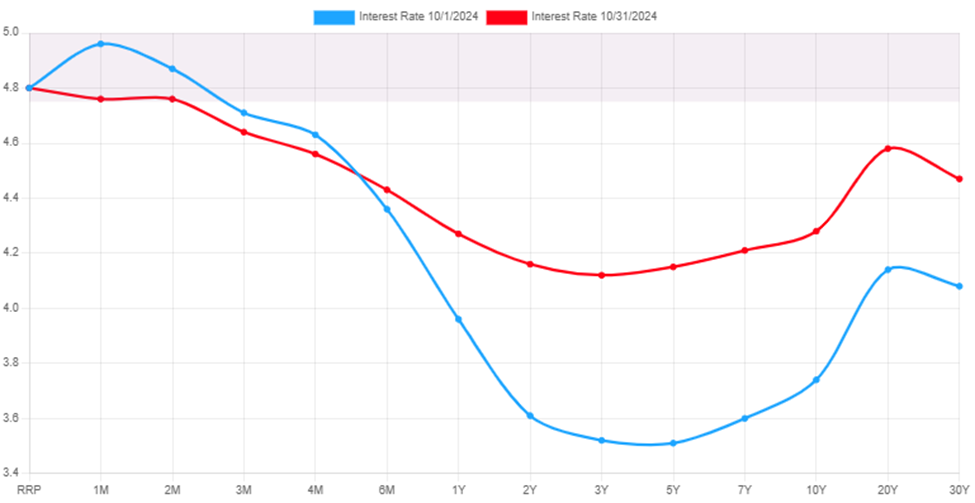

Bond markets went for a reversal ride in October. After several months of falling rates, we began to see a pullback in the bond market as interest rates rose. The 2-year treasury rose 0.55%, while the 10-year treasury rose 0.54%. The good news is that while rising, the rates did not invert again. The long picture remains intact. We are still in an elevated rate environment with them more likely to drift south rather than north. This move may have been the result of predictions for a potential structure that would mean tariffs. This would reflect a higher inflation potential which would signal a slower path in future rate cuts. Additional good news is that while rates from 6 months on rose, shorter duration rates continued to fall. This bodes well for the normalization of the entire curve.

Equities: Dow Jones 1.34% | S&P 500 0.99% | NASDAQ 0.52%

While it was a down month for equites, the overall move south was not bad for the month. From the top of the market for the S&P 500 (10/18/2024) to the end of the month logged a 2.83%. This proved to be a mild lead up to the beginning of November. The nice part is that while a correction has not materialized, earnings season did, bringing the P/E ratio for the S&P 500 back down to 21.19.

Throughout the month utility stock did well until the last week of the month. A shifting towards Financial and consumer discretionary was underway. Neither of which are surprising given interest rates (favoring financials) and the fact that we are in the fourth quarter… I like to say, ‘Americans spend money they do not have on things they do not need’, AKA: holiday season!

Conclusion

Equities pulled back less than was indicative of the rate move on the bond market. The move there signaled more concern about higher rates for longer than equities chose to price in. The shift in rates seemed like a long-term change in projection, while short rates seemed anchored to FRB actions. The longer rage rates often can be equated to long range GDP expectations. If the view is that we would have stronger forward GDP in 5 years, then we see a stronger 5-year rate.

A Look Ahead…

Market responses in October could have been far more drastic than they were. We should feel fortunate that we got the October that we did. This still leaves a correction (a market fall of 10% to 19%) unattended to. The last one ended 10/27/2023. While stretched P/E’s from over the summer have become more reasonable, that’s been due to strong earnings. Those may continue in the short run, but moving into 2025 those might be harder to come by. It may very well cause a correction in the first half of the year.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.

Markets rose steadily all week. Does this bode well for the summer months, or should we be concerned?

Monday

Markets were mostly up on Monday. Investor sentiment was buoyed by an announcement from the largest US banks. They announced that they will resume dividends as the Federal Reserve Bank (FRB) has lifted the moratorium.

Last year’s stress test result in healthy balance sheets, however, to be safe, the FRB had Banks suspend dividends. After this year’s stress test the FRB announced a return to dividends would be permitted.

Tuesday

The S&P 500 rose to an all-time high again on Tuesday, albeit a meager gain. In a continuation from Monday the Small Cap markets again shed weight while the large indices continued to gain. CB Consumer Confidence unexpectedly jumped to a pandemic high of 127.3.

Wednesday

The S&P 500 continued its record setting gains on Wednesday. Pending home sales jumped in June, however there are underlying indicators showing the housing market is slowing down.

Thursday

The fresh record highs each day continued for the S&P 500. The S&P was not alone as all major indices pointed north on Thursday. There was much optimism on the job front as early data looked good. Friday brings the full jobs report.

Friday

Markets jumped on Friday. The S&P 500 rose 0.8% on the day, with only the Small Cap markets retreating. While the unemployment rate crept up in June to 5.9% (from 5.7%), the private payroll adds were impressive. The increase in the unemployment rate post-recession is not surprising. Those who were not looking for work begin to rejoin the job market and increase this measure of unemployment.

Conclusion

Markets rose nicely for the week. The S&P 500 gained 71.64 points, or 1.67% on the week. More impressive was perhaps the sustained run of growth across the entire week. Although early in the week the movements were modest the sustained upward trend is a positive signal for investor mentality. The struggle is that we are moving into the summer months where volumes tick down and volatility can tick up.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.