The month of December did not bring gains as is typical. Monitoring the moves, markets gave us one hell of a ride.

Fixed Income: 2-Yr Treas Yield 4.25% | 10-Yr Treas. Yield 4.46%

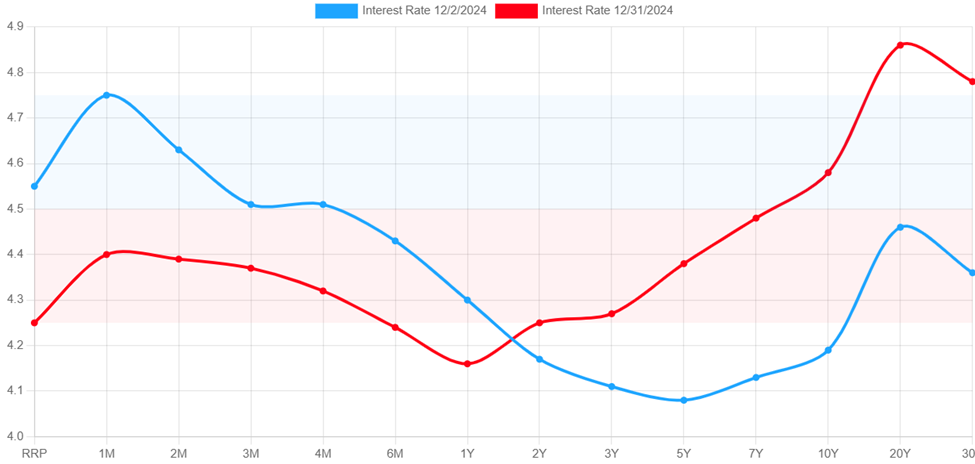

It was a rocky month for the fixed income markets. The Federal Reserve Board (FRB) announced a 0.25% rate cut on December 18th, which is typically a positive for markets. The problem was that the rate cut was accompanied by guidance that signaled that the FRB will likely only cut rates 2 times (or 0.50%) for all of 2025. They are being cautious over concerns that inflation may rear its ugly head. While rate cuts will still happen the reduced cutting pattern impacted rate expectations on the longer half of the curve. As depicted below rates under 2 years fell and from 2 years on all increased. As a reminder rates and price move in opposite directions.

Equities: Dow Jones 5.27% | S&P 500 2.50% | NASDAQ 0.48%

Stock markets took their queues from the fixed income market this last month. The markets were good to start December but quickly faded once we entered the FRB’s quiet period before their meeting. Equities really slipped on the 18th, however as future earnings will be hampered by higher overall costs. The NASDAQ lost 3.56%, the S&P 500 2.95%, and the Dow Jones 2.58% on that day alone. At that point the idea of a Santa Claus rally to end the year evaporated.

Conclusion

In all, 2024 was a fantastic year, but it surely ended on a sour note. Typically for every 9 to 12 months of growth we experience, we see a 1 to month pullback on markets. That did not occur during 2024, giving it the ability to be a robust year for markets.

A Look Ahead…

The lack of a correction in 2024 means that one to open 2025 is not only likely, but probable. The S&P 500 currently has a P/E ratio of 21.83, making it about 20% overpriced now. Q4 earnings will likely help adjust in some of that differential. At the same time, fears of inflation and a passive FRB will likely rein in prices as well.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.