The Monitor flashed Red in March. The Markets marched lower for the month. As April starts the same way, do we expect it to persist?

Fixed Income 2-Yr Treas Yield 3.89% | 10-Yr Treas. Yield 4.23%

As turmoil mounted across March the curve moved down, bringing profits to the core fixed income markets. Concerns over yet to be announced tariffs and what their implications could be kept uncertainty front and center for markets. In what seemed like a very orderly fashion we saw an equity sell off and a migration to fixed income.

The Federal Reserve Board met midmonth and as expected left rates unchanged. One change they made was to reduce Quantitative Tightening (QT). They are currently allowing $25B in treasuries to merely mature each month. That amount will be reduced to $5B. This adjustment creates stimulus, but in a far less measurable way than a change to interest rates. By only allowing $5B to mature, that means that they will be a buyer for another $2B in bonds that would have been maturing. This demand creation helps keep interest rates a little lower.

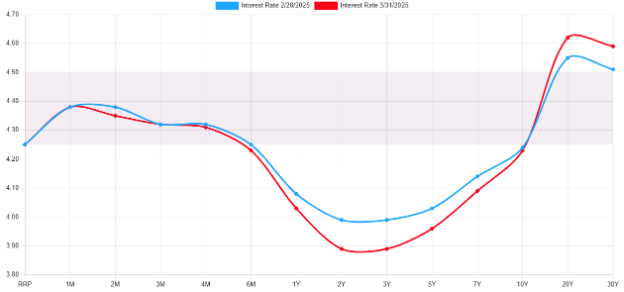

In all a bad month for equities results in a good month for core fixed income assets. As you can see from the chart below, 1-year through to 7-year treasuries all saw a meaning move down for the month (rates and process move in opposite directions).

*ustreasuryyieldcurve.com

Equities Dow Jones 4.20% | S&P 500 5.75% | NASDAQ 8.21%

Highs in the S&P 500 were reached as recently as February 19th, 2025. Given the events of the last 6 weeks, that feels like an eon ago! The S&P 500 hit its low point for March right at mid-month (3/13). Markets bounced late in the month, but as we sit here in the month of April, we know that bounce was short lived. The fundamental thing that occurred on March 13th, however, is that markets fell 10.21% from their February high. Marking our transition into a market correction. Market corrections often last 1 to 3 months and will range in severity from 10% to 19%. Should things extend past 19%, this would become a bear market.

Much of the moves to the south were the result of frequent (what felt like daily) announcements regarding new tariffs. The tariff charged is feared to flow through to the consumer creating inflation, inhibiting purchasing and creating a stagflation environment (low growth/high inflation).

Conclusion

There is still plenty to be determined as to how much of the tariffs will flow through to consumers as inflation. It is also to be determined if it will be enough to sideline the consumer and slow GDP into negative territory. The consumer makes up almost 70% of GDP. Sentiment and confidence readings would suggest that the consumer is not going to spend money, however, retail sales, factory orders, and durable goods orders tell us what is actually happening as opposed to how people feel and those numbers are yet to be showing signs of wear.

A Look Ahead…

This move in markets is still correction territory. If it feels swift, it is not. It has been rather paced and an orderly risk off type of process. I would look for that to continue. Escalations in tariff levels would signal more negative things for markets as it creates uncertainty. Negotiations and lowering tariffs would create a new growth cycle as it would signal clarity.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.