Monthly numbers for the stock market did not prove as bad as the intra-month swings. Digging into the monitor data, can we glean the path ahead?

Fixed Income: 2-Yr Treas Yield 3.60% | 10-Yr Treas. Yield 4.17%

The month of April was rife with data to move markets. The month opened with announcements of sweeping trade tariffs that would have undoubtedly caused a massive increase in inflation. Those tariffs were further compounded by a tit for tat retaliation between two nations. The increased risk of inflation signaled less incentive for the Federal Reserve Board (FRB) to cut interest rates. That would have merely been adding lighter fluid on a raging fire.

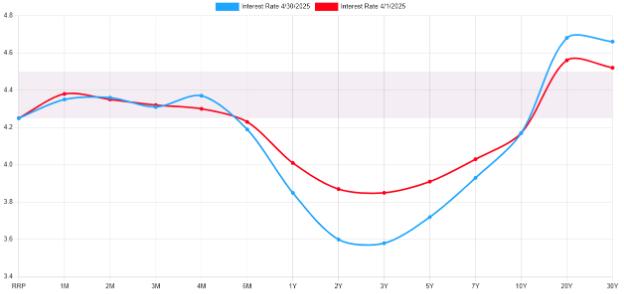

Per the chart, April’s rates opened (red) with a higher 2-year, but a lower 30-year as compared to month-end (blue). In actuality, the entire belly of this curve (2-yr to 20-yr) were all higher intra-month. This was a result of the risks tariffs were causing to the continuation of expansion. By the month’s end short-term risks had dissipated enough for 2-year treasury rates to be lower and 10-year rates roughly equal. As a reminder interest rates and bond prices move in opposite directions.

*ustreasuryyieldcurve.com

Equities: Dow Jones 3.17% | S&P 500 0.76% | NASDAQ 0.85%

The months’ swings were not contained in the fixed income markets. In fact, those paled in comparison to the swings seen in the equity markets. Between April 2nd and April 8th markets shed over 10% in market cap. The interesting part is that from that point going forward, April saw a solid regrowth of assets. So much so that the S&P 500 ended up being down under 1%, while the NASDAQ carried a positive handle! Additionally, the Price to Earnings ratio (P/E) for the S&P 500 has reduced to a more normalized level.

*investing.com/indices/us-spx-500-chart

Conclusion

While the tariff news was toxic to markets, the news of a 90-day reprieve to most tariffs was very meaningful. The first quarter Gross Domestic Product (GDP) came in at -0.3%. The first negative GDP reading since Q2 2022. This reading ran negative because of massive imports that occurred during the quarter, not a fall in consumer spending. A recession would be achieved if the second quarter also came in at a negative reading. Placing a 90-day reprieve on tariffs essentially creates a business-as-usual state for the consumer in this quarter. With the consumer representing upward of 68% of GDP, it is important that we keep spending for GDP. There is a chance Q2 could not only be “business-as-usual”, but rather robust as consumers try to beat the tariffs.

A Look Ahead…

With tariffs likely avoided in the first half of the year, the forward view will be focused on Jobs data. Jobs are at risk of deterioration as Corporate America may hold hiring for more clarity on the tariff front. If that happens and inflation does not materialize, the FRB may lower interest rates to help the jobs market. Rate cuts and previously mentioned consumer spending may lead to a strong back half of Q2 and start to Q3.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.