Monitoring equity markets this last month was easy as things climbed, The Fixed Income market was a bit different. What does it mean for the remainder of the year?

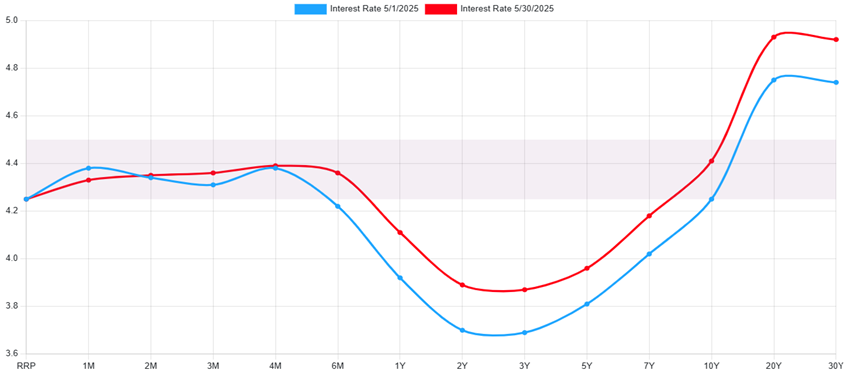

Fixed Income 2-Yr Treas Yield 3.89% | 10-Yr Treas. Yield 4.41%

___Bonds experienced a reversal last month, giving back some of the performance they have provided over the last several months. Much of the move gradually came throughout May, many attributing this change to Moody’s downgrade. However, that move did not outright cause the movement in interest rates. It did lend to a steepening yield curve, which could represent risks to some areas of the economy. Overall, this moves us further from a classical recessionary signal; an inversion in the curve between 2 and 10-year bonds. This signals less recession risk.

___Moody’s was the last of three rating agencies to downgrade US debt. The first was S&P Global back in 2011, then Fitch in 2023. The only thing exciting about the announcement is, well, nothing. It wasn’t a matter of “if,” but a matter of “when.”

*ustreasuryyieldcurve.com

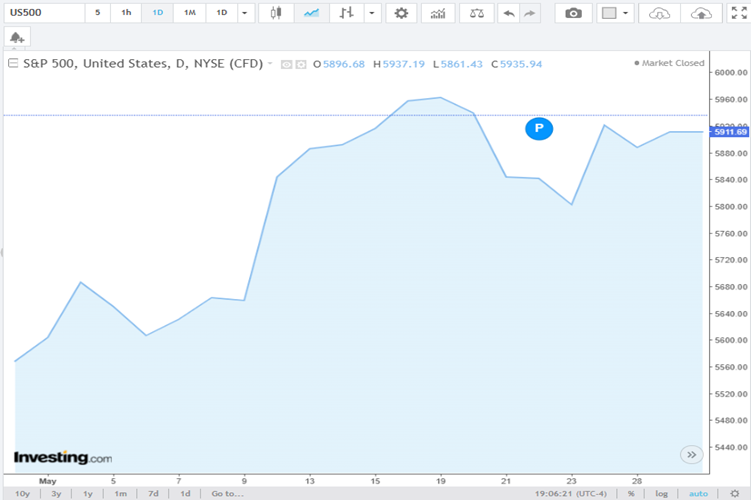

Equities Dow Jones 3.94% | S&P 500 6.15% | NASDAQ 9.56%

___In a stark reversal from the last several months, equities posted strong gains for the month of May. There is an adage for May, “Sell in May and go away”. It acknowledges the risk-off nature of the month that is considered to be inconsistent. Prior to COVID, it frequently occurred once out of every five years, but since then it has occurred more consistently. This year was officially different. The risk-off environment that coupled with Tariff announcements has subsided for cheers regarding progress on the trade front. The sell-off allowed for the S&P 500’ P/E ratios to return to a more reasonable point. The weakest point in the month did come following Moody’s downgrade announcement, but even that was marginal in nature.

*investing.com/indices/us-spx-500-chart

Conclusion

___Bonds helped stabilize portfolios through the storm that was February, March, and April. Equities provided a similar buffering in May against rising rates in the fixed income markets. May is not typically a month for string equity performance, but it was welcomed after the weakness experienced since February.

A Look Ahead…

___There are plenty of headline risks to look at and be concerned about, however some signals bring hope. GDP estimates for Q2 have been sharply increased by the Federal Reserve Bank (FRB) of Atlanta. Their GDPNow gauge estimates second quarter GDP at a staggering 4.6%! This jump was attributed to personal consumption expenditures released thus far in this quarter. Additionally, the FRB’s preferred inflation gauge lowered to 2.1% in April. Just a mere 0.1% away from the FRB’s target of 2%. It is expected that inflation should climb later this year but could remain fairly contained. With inflation close to target, the FRB may shift its attention to unemployment, which could float up this fall. These factors combined with a chance of fiscal stimulus could create a decent back half of 2025.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.