The Markets flashed green and red across the monitor this month. One is telling us about the past while the other might be giving us clues into the future.

Fixed Income: 2-Yr Treas Yield 3.94% | 10-Yr Treas. Yield 4.37%

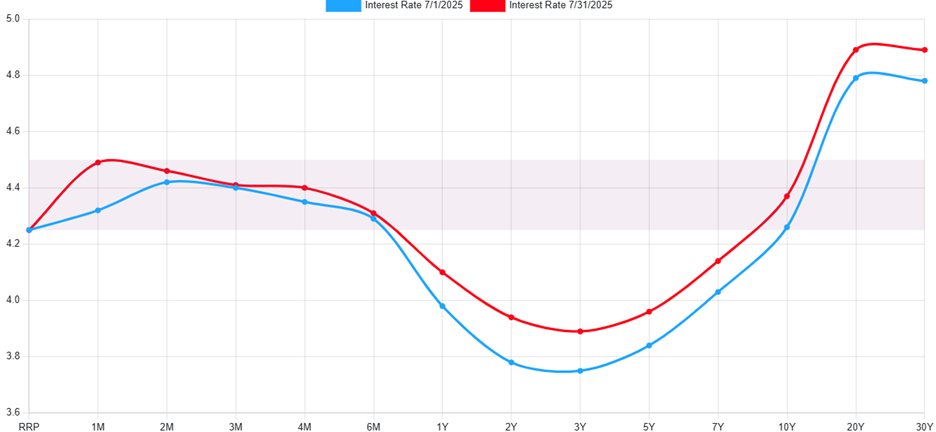

Overall interest rates went up in the month of July. As a reminder interest rates and prices move in opposite directions. Much of the short end movement happened at the beginning of the month with the rival of tariff talk. Additionally, on the last day of July, markets shifted short bonds higher as inflation came in hotter than expected. While typically a signal of reduced likelihood of rate cuts, expectations increased on July’s jobs report (August 1st). The jobs data sent everything from 3 Months to 20 Years to sub-July 1st rates.

More concerning than the uptick in rates is the spread between the 2-year treasury and the 10-year treasury has narrowed. When these values invert (currently 0.43% positive) it is generally a strong signal of an impending recession. Their current position is good, however weakening.

*ustreasuryyieldcurve.com

Equities: Dow Jones 0.08% | S&P 500 2.14% | NASDAQ 3.70%

Equities did well for the most part in July. The Dow Jones lagged its peers as exposure to United Health (UNH) and IBM (IBM) dragged it down in July. It can be seen from the graphic below when earnings season got underway (July 15th), markets began to climb. Prior to that, markets were fairly neutral to positive. The One Big Beautiful Bill assisted markets; however its effect was likely more muted as talk regarding tariffs ramped up. In addition to earnings, favorable news regarding chips sales to China and a trade deal with Japan helped buoy markets.

*investing.com/indices/us-spx-500-chart

Conclusion

While equity markets climbed for the month of July in general, the fixed income markets told a story of caution. The equity markets have barreled ahead on earnings data that reflects a Q2 2025 that was strong. The fixed income markets, however, are showing signs of potential weakness in the back half of 2025.

A Look Ahead…

The FRB’s dual mandate of full employment (appx 4%) and 2% inflation put them in a catch 22. They acknowledge that inflation will likely increase in coming months, but that it will likely be temporary. This is a signal they are less concerned the increase will keep them from their intended target of 2%. Meanwhile they have expressed reservations that joblessness will likely increase in coming months, with no sign of slowing. With the FRB being data-dependent and current measures within proximity to targets, they have little room to act. The Jobs report Friday gave us a strong indication of a slowing jobs market. Interestingly, we will get two Jobs reports before the next FRB meeting. This should give them ample data to firm their stance on the matter. The likelihood of an FRB rate cut in September has increased dramatically in the last week. This would leave them two additional meetings for 2025. This means we could see a total of three rate cuts ahead… if the jobs data warrants it!

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.