Monitoring the Markets this last month was some fun for sure. Gains mounted from May into a strong June. Can those gains be sustained?

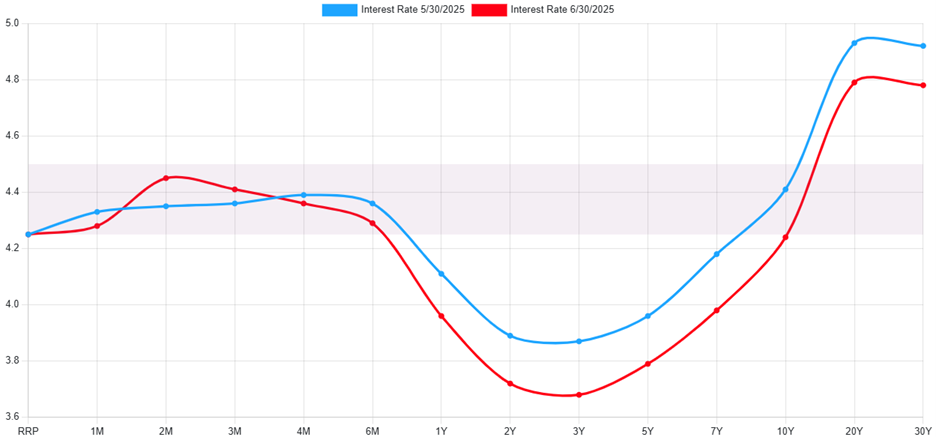

Fixed Income: 2-Yr Treas Yield 3.72% | 10-Yr Treas. Yield 4.24%

___Yields fell across the curve for the month of June. This was not the case as the month began. At the onset interest rates rose as expectations increased. This was on concern that the Federal Reserve Bank (FRB) would decrease rate cut projections to one cut for 2025. The FRB meeting occurred, and projections remained at two for 2025, which reshaped the curve as you see below. As a reminder, interest rates and prices move in opposite directions. Municipalities have experienced a bid as of late as new issue markets have heated up in recent months. There is speculation that post COVID funds are drying up, returning municipalities to their main funding source, the bond market.

*ustreasuryyieldcurve.com

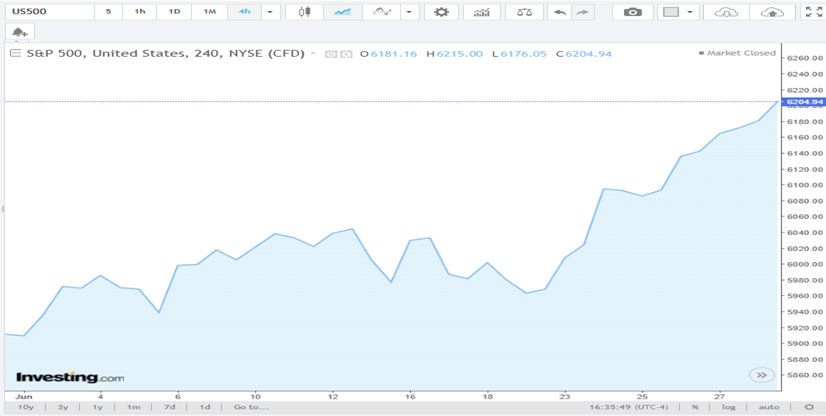

Equities: Dow Jones 4.23% | S&P 500 4.53% | NASDAQ 5.86%

___Markets moved in tandem this last month. It was not just the bond markets that applauded the FRB decision to keep the rate cut projection at two. Equities extended the rally from May to June. This gave indices the ability to move into positive territory year-to-date and recapture all-time highs at quarter end:

YTD

Dow Jones: 4.02%

S&P 500: 5.73%

NASDAQ: 5.65%

___While markets gained in the front half of the month, momentum truly picked up after the April 18th FRB meeting. The moves post FRB meeting show the confidence in instilled in markets for future stimulus to finally arrive.

*investing.com/indices/us-spx-500-chart

Conclusion

___While news the FRB would likely still cut rates twice was received well, in reality it signals economic weakness ahead. The FRB’s ever cautious approach may make them late in responding to job losses and a lack of inflation. All projections currently have inflation experiencing a moderate resurgence in the next few months. More concerning is that the FRB has the unemployment rate floating up to 4.5% by year end.

A Look Ahead…

___The momentum from June should carry throughout the third quarter as fiscal stimulus is likely in the next week. Assuming the July 4th deadline can be met. More importantly corporate earnings (currently projected at 2.9% GDP by the Atlanta FRB) will begin in a few weeks. The strong quarter should yield some decent equity performance throughout the remainder of the summer.

___Turbulence is possible by July 9th (or several variations thereof, i.e. Canada and Europe) as tariff deadlines loom. We should see the needle move on trade deals in the next few weeks to prevent a dramatic market move. If not, it is likely that some good faith extensions will be provided for countries actively negotiating. Those moves would smooth market volatility and allow corporate earnings, and fiscal stimulus room to run.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.