The Month ended for the better for markets. However, it made some shifts along the way that that are worth monitoring!

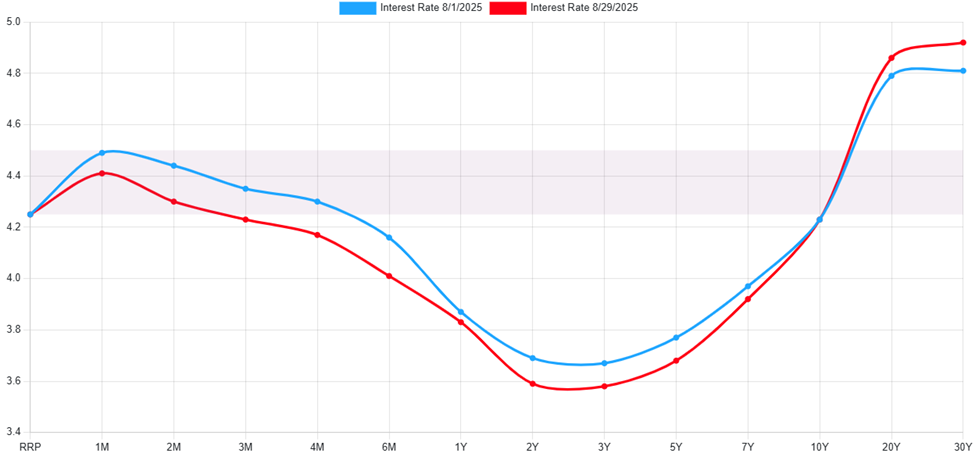

Fixed Income: 2-Yr Treas Yield 3.59% | 10-Yr Treas. Yield 4.23%

Treasury yields fell on the front over the curve, while it rose at the tail of the curve. Intra-month movement was a different story, marked specifically by August 22nd. That was when the Federal Reserve Board (FRB) chair, Jay Powell, spoke at the economic policy symposium at Jackson Hole. His speech opened a likelihood of interest rate cuts to begin as early as September 17th. That moved interest rates lower.

*ustreasuryyieldcurve.com

Equities: Dow Jones 3.20% | S&P 500 1.91% | NASDAQ 1.58%

Equities experienced a positive month overall as well. But as with fixed income, equities were a tail of two halves of the month. The first half of the month experienced gains on outperformance of Q2 earnings season. As we moved closer to the FRB’s speech, markets began to fade those gains. Markets recaptured the fade almost immediately following the FRB speech. Those gains stuck through month end, where markets sold on weak Nvidia earnings.

*investing.com/indices/us-spx-500-advanced-chart

Conclusion

This marked the 3rd month of gains in a row for markets. The price to earnings ratio for markets are beginning to stretch again where equities no longer look cheap. Opportunity persists in the international markets as the tariff environment and FRB rate cuts lend themselves to a weaker dollar. That weakness could act as a sweetener to performance over the coming years.

A Look Ahead…

This makes the selloff in the spring seem like a distant history, but it is not! The issues that were there in the spring still persist today and could cause future turmoil. September historically is a weaker month for stock market performance. It will be aided by a potential FRB rate cut, but two head winds could contribute to a weaker September:

- The end of earnings season and the void of information that ensues.

- The looming budget reconciliation that needs to be done to avoid a government shutdown a month’s end.

Government shutdown headlines could cause turmoil late in the month, eliminating some of the benefits of a rate cut.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.