The month saw green across major metrics on the monitor. Could market growth have been better?

Fixed Income: 2-Yr Treas Yield 3.60% | 10-Yr Treas. Yield 4.11%

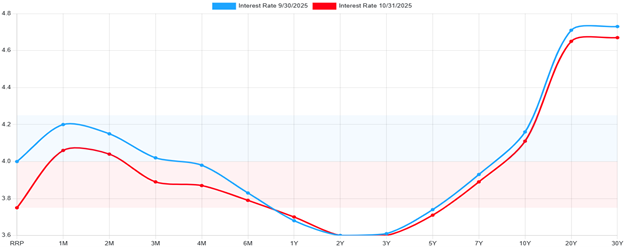

The yield curve was little moved across October. This may have been because the Federal Reserve Board (FRB) did not meet until 10/28-10/29. The FRB meeting yielded the expected rate cut. However, it came with updated language saying a rate cut in December is not a foregone conclusion. This will push rates up in a minor way.

Rates fell across the curve in October. This came with an exception in the form of the 2-year and 3-year yields. They were flat for the month. This means that the yield curve narrowed across October. However, the difference between the 2-year and the 10-year remains firmly in a positive curve. This reflects that a recession is quite some way out.

*ustreasuryyieldcurve.com

Equities: Dow Jones 0.99% | S&P 500 2.27% | NASDAQ 0.61%

Market gains for the month were all positive for the major indices; however, they were all marginal. Part of what made it marginal occurred on October 10th (as visible on the chart below). China was targeted unexpectedly with hefty tariff language.

*investing.com/indices/us-spx-500

While we saw gains for major indices, various areas of the market were negatively impacted for the month:

Large Value: 2.04% Large Growth: 2.67%

Mid Value: 1.45% Mid Growth: 0.26%

Small Value: 0.35% Small Growth: 1.39%

REIT: 1.84%

Meanwhile international markets fared better:

International Large Equities: 1.20%

Emerging Market Equities: 3.56%

International Bonds: 1.00%

Emerging Market Bonds: 1.97%

Conclusion

As we all already know, the government shutdown came on October 1st and was still here as of November 1st. As you can see from the numbers above, it appears as though it was a non-issue for markets. In all actuality, this is true. Market growth was driven by corporate earnings and deals in AI/Tech as AI infrastructure continues to remain in focus. However, it stands to reason that gains would have been better had the uncertainty of a shutdown not been there.

A Look Ahead…

When the government shutdown becomes a thing of the past, there may be a slight pop to markets. At that point the attention will switch to expectations around delayed reports rolling out. Also, there will be a focus on retail sales as we will be well into the 4th Quarter. A quarter driven by consumer spending leading into the holidays. As inflation has taken a bite out of paychecks, holiday spending rates are still expected to increase by 10%.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.