Market moves across the month were to the south. Fixed income markets seemed to have a more drastic message on the monitor than that of equities.

Fixed Income: 2-Yr Treas Yield 4.16% | 10-Yr Treas. Yield 4.28%

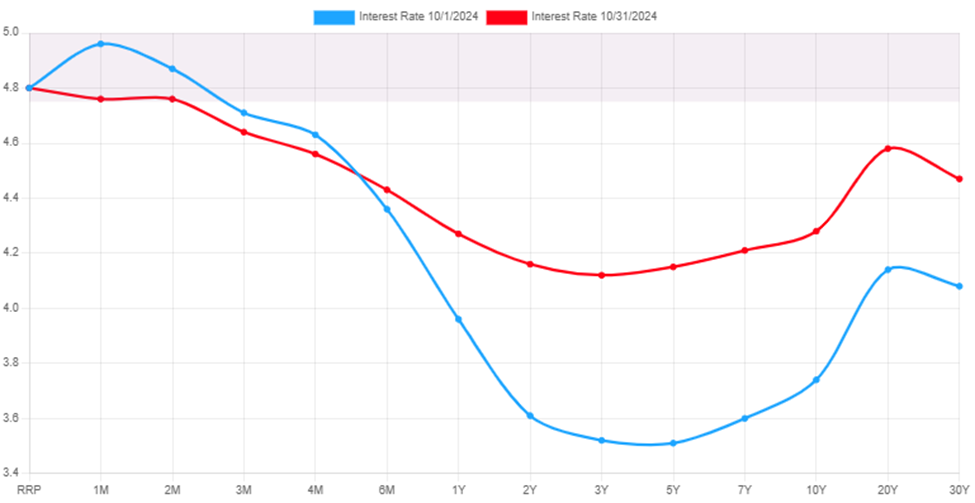

Bond markets went for a reversal ride in October. After several months of falling rates, we began to see a pullback in the bond market as interest rates rose. The 2-year treasury rose 0.55%, while the 10-year treasury rose 0.54%. The good news is that while rising, the rates did not invert again. The long picture remains intact. We are still in an elevated rate environment with them more likely to drift south rather than north. This move may have been the result of predictions for a potential structure that would mean tariffs. This would reflect a higher inflation potential which would signal a slower path in future rate cuts. Additional good news is that while rates from 6 months on rose, shorter duration rates continued to fall. This bodes well for the normalization of the entire curve.

Equities: Dow Jones 1.34% | S&P 500 0.99% | NASDAQ 0.52%

While it was a down month for equites, the overall move south was not bad for the month. From the top of the market for the S&P 500 (10/18/2024) to the end of the month logged a 2.83%. This proved to be a mild lead up to the beginning of November. The nice part is that while a correction has not materialized, earnings season did, bringing the P/E ratio for the S&P 500 back down to 21.19.

Throughout the month utility stock did well until the last week of the month. A shifting towards Financial and consumer discretionary was underway. Neither of which are surprising given interest rates (favoring financials) and the fact that we are in the fourth quarter… I like to say, ‘Americans spend money they do not have on things they do not need’, AKA: holiday season!

Conclusion

Equities pulled back less than was indicative of the rate move on the bond market. The move there signaled more concern about higher rates for longer than equities chose to price in. The shift in rates seemed like a long-term change in projection, while short rates seemed anchored to FRB actions. The longer rage rates often can be equated to long range GDP expectations. If the view is that we would have stronger forward GDP in 5 years, then we see a stronger 5-year rate.

A Look Ahead…

Market responses in October could have been far more drastic than they were. We should feel fortunate that we got the October that we did. This still leaves a correction (a market fall of 10% to 19%) unattended to. The last one ended 10/27/2023. While stretched P/E’s from over the summer have become more reasonable, that’s been due to strong earnings. Those may continue in the short run, but moving into 2025 those might be harder to come by. It may very well cause a correction in the first half of the year.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.

Growth or inflation, which will command the interest of investors? Did you see what I did there???

Monday

The movement for the day was generally in the green. This came off weekend news that the senate passed the $1.9T stimulus package. It is now headed back to congress to ratify the modifications. Late it the day interest rates surged (for the same reason) as concerns around inflation increased. This surge caused the rally to fade, and markets ended the day in the red.

Tuesday

Markets surged strong on Tuesday. Led by the NASDAQ, sending a sign that there may have been too much made of the recent inflation trade. The S&P 500 rose 1.84%, while the NASDAQ posted its strongest single day gains since November.

Wednesday

Oil inventories rose more than expected and Consumer Prices rose less than expected. Markets climbed early on the better than expected inflation data. They held onto those gains through the close.

Thursday

Markets rose on Thursday with the S&P 500 rising 1.05%. The NASDAQ, however led the way at 2.51%. Jobless claims fell to the lowest level since December. Additionally, Job openings were higher and showed promise.

Friday

The interest rate environment was back in focus as rates climbed Friday morning. With that markets started the day deep in the red. They spent the day digging out of the whole and finished in the green. A good sign, as investors felt comfortable being long the market heading into the weekend.

Conclusion

This last week was a strong week for markets, with the S&P 500 rising 2.64% on the week. While caution still exists around interest rates, markets seemed to have realized that the rising rates as a result of rapid growth expectations was actually a good thing. The anticipated inflation risks are expected to be transitory, fading by early 2022.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.