Market moves across the month were to the south. Fixed income markets seemed to have a more drastic message on the monitor than that of equities.

Fixed Income: 2-Yr Treas Yield 4.16% | 10-Yr Treas. Yield 4.28%

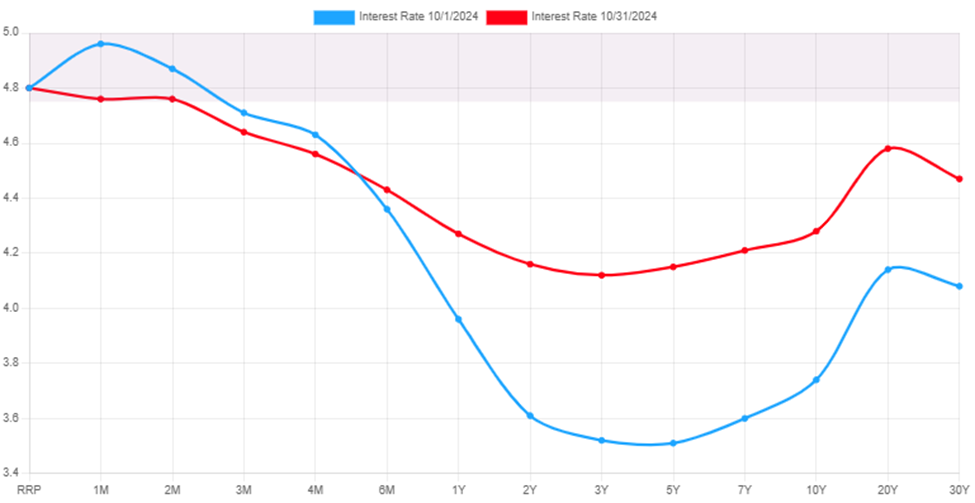

Bond markets went for a reversal ride in October. After several months of falling rates, we began to see a pullback in the bond market as interest rates rose. The 2-year treasury rose 0.55%, while the 10-year treasury rose 0.54%. The good news is that while rising, the rates did not invert again. The long picture remains intact. We are still in an elevated rate environment with them more likely to drift south rather than north. This move may have been the result of predictions for a potential structure that would mean tariffs. This would reflect a higher inflation potential which would signal a slower path in future rate cuts. Additional good news is that while rates from 6 months on rose, shorter duration rates continued to fall. This bodes well for the normalization of the entire curve.

Equities: Dow Jones 1.34% | S&P 500 0.99% | NASDAQ 0.52%

While it was a down month for equites, the overall move south was not bad for the month. From the top of the market for the S&P 500 (10/18/2024) to the end of the month logged a 2.83%. This proved to be a mild lead up to the beginning of November. The nice part is that while a correction has not materialized, earnings season did, bringing the P/E ratio for the S&P 500 back down to 21.19.

Throughout the month utility stock did well until the last week of the month. A shifting towards Financial and consumer discretionary was underway. Neither of which are surprising given interest rates (favoring financials) and the fact that we are in the fourth quarter… I like to say, ‘Americans spend money they do not have on things they do not need’, AKA: holiday season!

Conclusion

Equities pulled back less than was indicative of the rate move on the bond market. The move there signaled more concern about higher rates for longer than equities chose to price in. The shift in rates seemed like a long-term change in projection, while short rates seemed anchored to FRB actions. The longer rage rates often can be equated to long range GDP expectations. If the view is that we would have stronger forward GDP in 5 years, then we see a stronger 5-year rate.

A Look Ahead…

Market responses in October could have been far more drastic than they were. We should feel fortunate that we got the October that we did. This still leaves a correction (a market fall of 10% to 19%) unattended to. The last one ended 10/27/2023. While stretched P/E’s from over the summer have become more reasonable, that’s been due to strong earnings. Those may continue in the short run, but moving into 2025 those might be harder to come by. It may very well cause a correction in the first half of the year.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.

Nothing to see here. Markets jumped out to open the week and then did a whole lot of nothing…

Monday

The Santa Claus rally got under way Monday morning. There were hundreds of Christmas eve flights cancelled due to Omicron. These should have led to dampened investor moods as it could signal the potential for a shutdown. They did not; the S&P climbed more the 1% to open the week.

Tuesday

The rally from Monday did not sell off, but it also did not advance. The trade activity on Tuesday was decidedly sideways as the S&P 500 lost 0.1%. This came as trading volume continued to be light amidst the holidays.

Wednesday

Trade was boring again on Wednesday as markets rose marginally. The S&P 500 rose a whopping 0.11%. Again, trading volumes were light, and the news feed was practically non-existent.

Thursday

Markets soared to open the week and made the remainder of the week boring as markets pretty much remained little changed on Thursday. The S&P 500 fell 0.28%.

Friday

The continued trend of light trading persisted. We expect this to change next week as traders get back to work. Movement was narrow across the day with the S&P 500 little changed on the day.

Conclusion

The opening day of the week did not set the tone for the week, but it did set the desired rise. This was evident by the minimal move throughout the remainder of the week. Granted, news was light. However, movement would have been more pronounced had there been more news to trade on. The S&P 500 ended up gaining 0.68% for the week and 26.89% for the year.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.