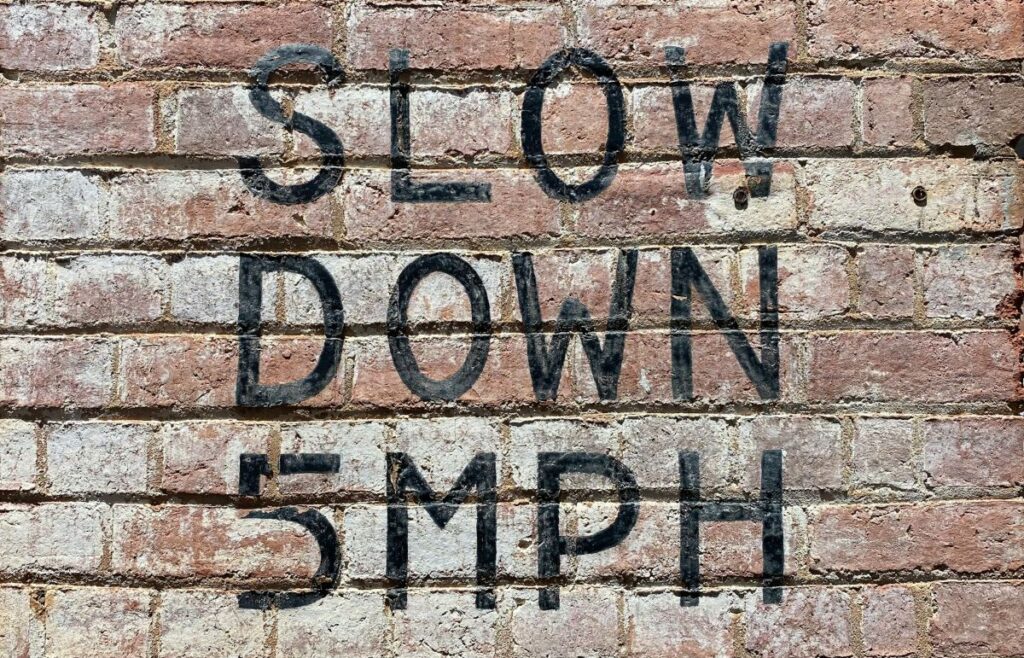

Markets pushed down on the accelerator in July and set multiple records. Will the pace continue or is there a reduced speed warning ahead?

Monday

S&P 500 0.02% | NASDAQ 0.33%

The S&P 500 and Nasdaq continued further into record territory while value and small cap stocks fell. A U.S. and European Union Trade deal began to take form, favoring growth stocks.

Tuesday

S&P 500 0.30% | NASDAQ 0.38%

Consumer confidence rose in July, which is likely due to cooling tariff fears and forward-looking guidance of a relatively strong but slowing economic environment. Markets, however, trimmed their gains from the past couple of weeks.

Wednesday

S&P 500 0.12% | NASDAQ 0.15%

Markets stalled even though Gross Domestic Product for the 2nd quarter is projected at 3%, higher than expected. The big news for the day was the Federal Reserve Board’s decision to keep rates between 4.25%-4.5%. Although this was expected, two board members dissented, citing risks in the labor market as one of their key concerns. This was the first time in over 30 years that a Federal Open Market Committee (FOMC) meeting recorded multiple dissents.

Thursday

S&P 500 0.37% | NASDAQ 0.03%

Markets fell after news reported that price increases ticked higher in June, which was partly attributed to tariff related price pressures. The inflationary pressures, while unwelcome, were expected.

Friday

S&P 500 1.60% | NASDAQ 2.24%

Markets tumbled at the open in reaction to updated tariff rates and jobs added news in July. Volatility jumped early in the morning on the announcements from the administration on tariffs and the Bureau of Labor Statistics. The jobs data came in much lower than forecasted, possibly signally weakness in the labor market. The probability of a rate cut swung from 35% chance to an 80% chance in September.

Conclusion

S&P 500 2.36% | NASDAQ 2.17%

The battle between achieving “normal” inflation readings and maintaining a strong labor market continues to wage on. Although promising progress has been on the inflation front, economists worry that tariff related inflation has yet to trickle through. There were two opposing viewpoints, however, by board members of the FOMC which may lend itself to a policy change as we look to the end of the year. For robust earnings and outlook to remain positive, the need for a strong labor force remains key for policy makers. This week’s data release for jobs added in July was weaker than forecast and past months’ data was revised downward. A wait and see approach from the Federal Reserve (their preferred method) may weigh on growth late in the year. A soft-landing would imply that labor strength maintains, and the oft-cited tariff inflation concern blows over. Instead of reacting quickly, the Federal Reserve has indicated they prefer to slow down before making a significant policy decision.

~ Your Future… Our Services… Together~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.