Markets were moving and shaking, but the monitor looks boring when you look at the month-over-month numbers. What really went on???

Fixed Income: 2-Yr Treas Yield 3.47% | 10-Yr Treas. Yield 4.02%

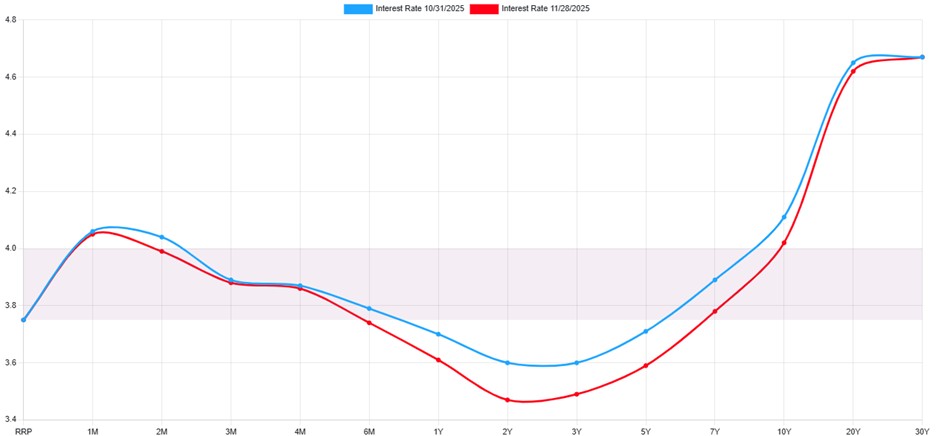

There was no Federal Reserve Bank (FRB) meeting in November. This is relevant as FRB meetings will often cause more movement in rates. Early in the month rates were little changed as there was nearly no data released due to the government shutdown. Jobs data that came out after the shutdown ended raised questions opposing a rate cut for December. Those initial concerns have since been calmed by recent speaking points from various FRB governors. This allowed them to move in a more favorable direction as the month ended. Importantly, the gap between the 2-year treasury and the 10-year treasury expanded, planting us more firmly within an expansion.

*ustreasuryyieldcurve.com

Equities: Dow Jones 0.32% | S&P 500 0.13% | NASDAQ 1.51%

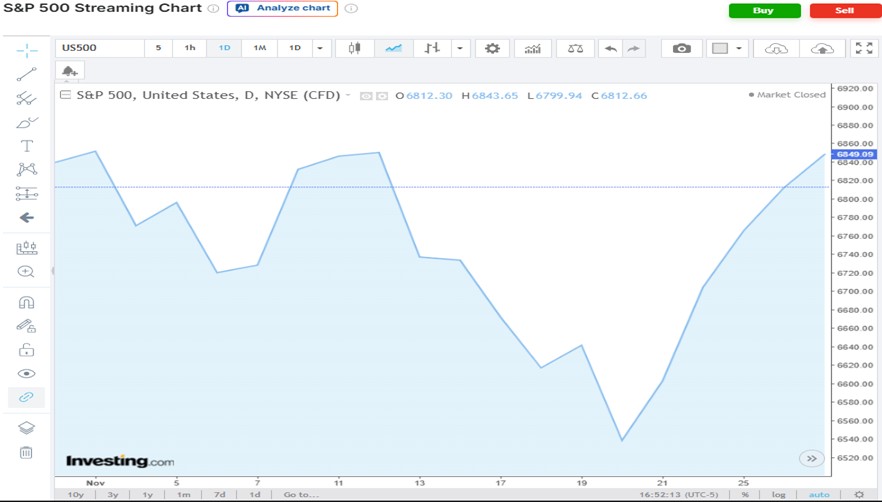

Equities didn’t enjoy such a linear fate. Looking at headline figures for equities, it looks as though the Nasdaq got roughed up while the S&P 500 was boring. Markets were fairly stable to open the month, however; after the government re-opened, the flow of data concerned markets. Fears of no change in rates gripped Large Growth markets. The volatility was particularly focused on Artificial Intelligence stocks in the communications and technology sectors. As those concerns dissipated so did the volatility in the index.

*investing.com/indices/us-spx-500

*investing.com/indices/volatility-s-p-500-chart

Conclusion

For a month when it felt like markets got roughed up, they actually held up okay. Bonds performed solidly, equity markets did not gain ground, and the Dollar resumed falling in value to the Euro. Muted volatility during the shutdown came out as it ended. 43 days of data decided to flow in 10 days which caused disruption to the normal flow of information. That wave of information has since dissipated.

A Look Ahead…

The focus will now shift to the consumer. Between Black Friday and Cyber Monday, consumer spending will be in focus as the indicator of GDP production for Q4. The current Atlanta Fed GDPNow forecast is 3.9%.

Additionally, focus will still fall on the FRB as they meet on December 10th. There is little information for the FRB to go on as October Jobs data does not exist. The November Jobs data is expected on December 16th and Consumer Price Index comes out December 18th. The FRB decision will still be relying largely on private data that does not paint the whole picture. For several reasons, it is expected that the FRB will stay the course and cut rates 0.25% on December 10th.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.