The month of December came and went without markets moving much. Does this signal anything specific for 2026? We are monitoring the situation, see our thoughts below.

Fixed Income: 2-Yr Treas Yield 3.47% | 10-Yr Treas. Yield 4.18%

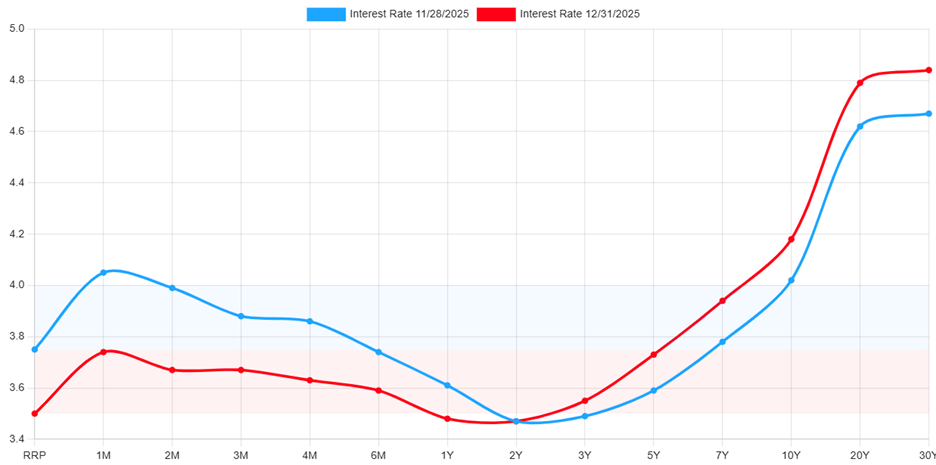

Interest rates on the long end of the curve rose in December, while the short end of the curve fell. Interest rates move in opposite directions to price. The Federal Reserve Board (FRB) delivered the expected cut in December, but also delivered the more hawkish tone for 2026. This resulted in short rates falling in response to the cut, while long rates rose on slowing cuts ahead.

*ustreasuryyieldcurve.com

Equities: Dow Jones 0.73% | S&P 500 0.05% | NASDAQ 0.53%

Equities limped into the end of the year. The year in whole reflected strong performance for growth assets. However, profit pulling into year end led to a soft performance for the month of December overall. The last week of December we usually get a boost to equities, referred to as ‘The Santa Claus Rally’. This rally never materialized, leaving equities in a lackluster place for the month. Leadership in equities over the last month has come from Materials, Healthcare, Financials, and Industrials. Many of which are prototypically Value assets and more defensive in nature.

*investing.com/indices/us-spx-500

Conclusion

The year was strong overall, but as mentioned earlier the market limped into the close. This could have been a profit pulling move before the calendar flipped over to 2026. It also could have been a sign of fatigue in the current economic environment. Inflation has remained fairly benign, CPI coming in at 2.6% in November, down from 3% the prior month. However, the job market is showing damage as the unemployment rate rose to 4.6% in November. This combination typically signals more rate cuts ahead; however, the falling prospect of those cuts may be causing this fatigue.

A Look Ahead…

This fatigue does not signal immediate harm to markets, but a lack of momentum carrying into the new year. Strategic diversification is important at impasses like this. Traditional growth of stagnation, other areas may have the potential to offset that drag.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.