Markets were little changed last month. But a quick look at the monitor shows us that there may be a changing of the guard…

Fixed Income: 2-Yr Treas Yield 3.52% | 10-Yr Treas. Yield 4.26%

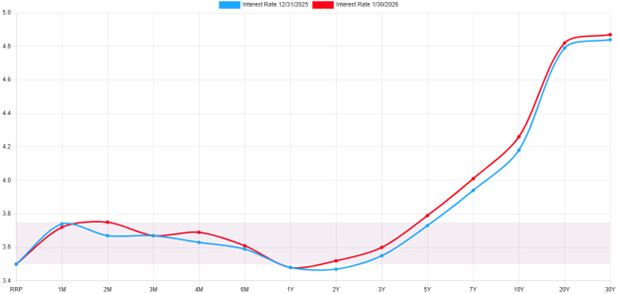

Interest rates were little changed across the month. This was expected as the Federal Reserve Bank (FRB) was set to deliver no rate cuts in their January meeting… and they delivered… It is weird to look at no action as delivering, but that is the case. The next FRB action is not expected until the June 17th meeting[1]. The lack of action causes interest rates to rise slightly as we have stagnated at 3.50% – 3.75%.

*ustreasuryyieldcurve.com

Equities: Dow Jones 1.73% | S&P 500 1.37% | NASDAQ 0.95%

Equity Markets did well in January, but not by much. Volatility throughout the month was up. It specifically spiked surrounding the weekend of Maduro’s capture as that stirred uncertainty. However, excluding that event, it has climbed across the month. Leadership in equities shifted in January as Large Value stocks, as measured by the Russell 1000 Value Index[1] earned 4.56% in January.

[1] Russell 1000 Value Total Return Historical Data (RLVTRI) – Investing.com

*investing.com/indices/us-spx-500

Conclusion

Equities performed relatively well throughout January, even with some volatility events along the way. The CBOE VIX has elevated meaningfully but still sits low in comparison to stock market correction events. Fixed income behaved counter to equities which is to be expected, however neither side moved dramatically in January.

A Look Ahead…

Value stocks outperformed the growth heavy NASDAQ in January, and this may be a sign of things to come. Typically, during a period of elevated rates, value stocks gain favor. The risk is this could be a false start as has been the case during market corrections over several years. Elevated volatility and slightly restrictive rate policy could be the way we see a sustainable value play in US equities.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.