Monthly data diverged between fixed income and equities for February. In monitoring the situation, will markets continue to run in opposite directions?

Fixed Income: 2-Yr Treas Yield 3.99% | 10-Yr Treas. Yield 4.24%

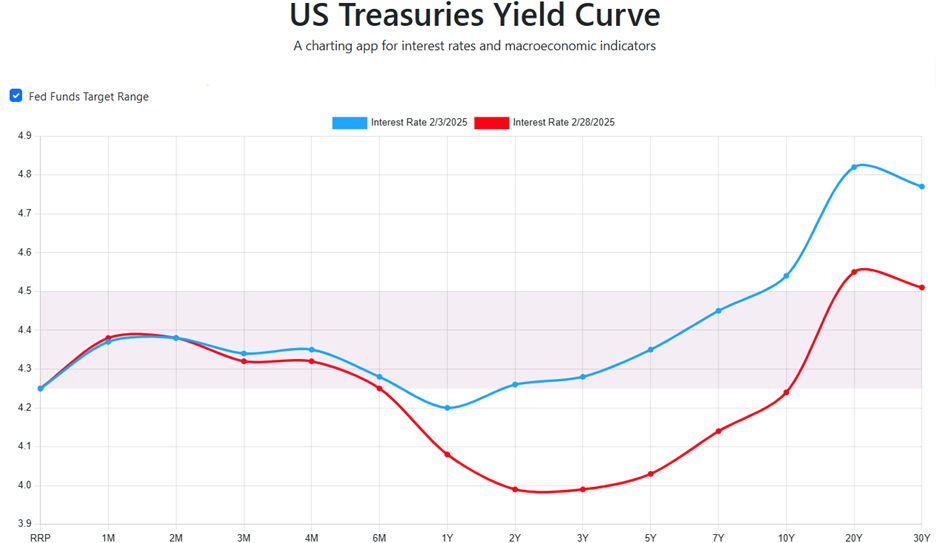

Rates moved in a helpful direction for the month of February. This was good news as the equity markets were not as kind. The divergence of performance helped buffer portfolios against the risks in the market for February. Until February 19th rates were moving in a narrow band, after that point that we saw longer rates dip meaningfully. There was a bevy of indicators throughout February that signaled higher inflation expectation along with weaker economic conditions. 5-year inflation expectations were up, Consumer confidence was down, and Personal Consumption Expenditure estimates rose. All these things signal an economic state that will leave us with stubborn inflation and low economic growth. Current rates make it look like the Federal Reserve Board (FRB) will likely be only 0.50% lower in two years.

*ustreasuryyieldcurve.com

Equities: Dow Jones 1.58% | S&P 500 1.42% | NASDAQ 3.97%

Equity markets did not fare as well as fixed income markets. The weakening economic conditions that favored the fixed income markets were like kryptonite to equity markets. They signal the potential for slowing earnings data out of wall street, effecting future valuations. Markets have been on a bull run since October of 2023, so recent volatility could signal a market correction. While the month of February was 1.42% for the S&P 500, it is down 4.79% since February 18th. A 10% correction would be achieved at 5,529.73.

Conclusion

Recent market activity, while painful, has been orderly. The CBOE S&P 500 VIX index has risen to 22.78 as of March 3, 2025. VIX is an attempt at measuring future volatility. Take the VIX and divide it by 30, that is the expected daily movements over the coming month. We still sit at approximately 0.76% daily moves. That is an above trend reading but still low in a market correction environment. Look for bonds to continue to support an equity downturn.

A Look Ahead…

Recent market weakness may be enough to bring back a dovish tone from the FRB when they meet March 19th. The expectation in no way would be for a FRB rate cut, but perhaps a modification to bond buy/sell activity. It is a very indirect way that the FRB could provide short-term accommodation for the economy. That would also apply downward pressure on rates as they would be reducing supply on the secondary bonds market.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.