| AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, CPI, FRB, Rates |

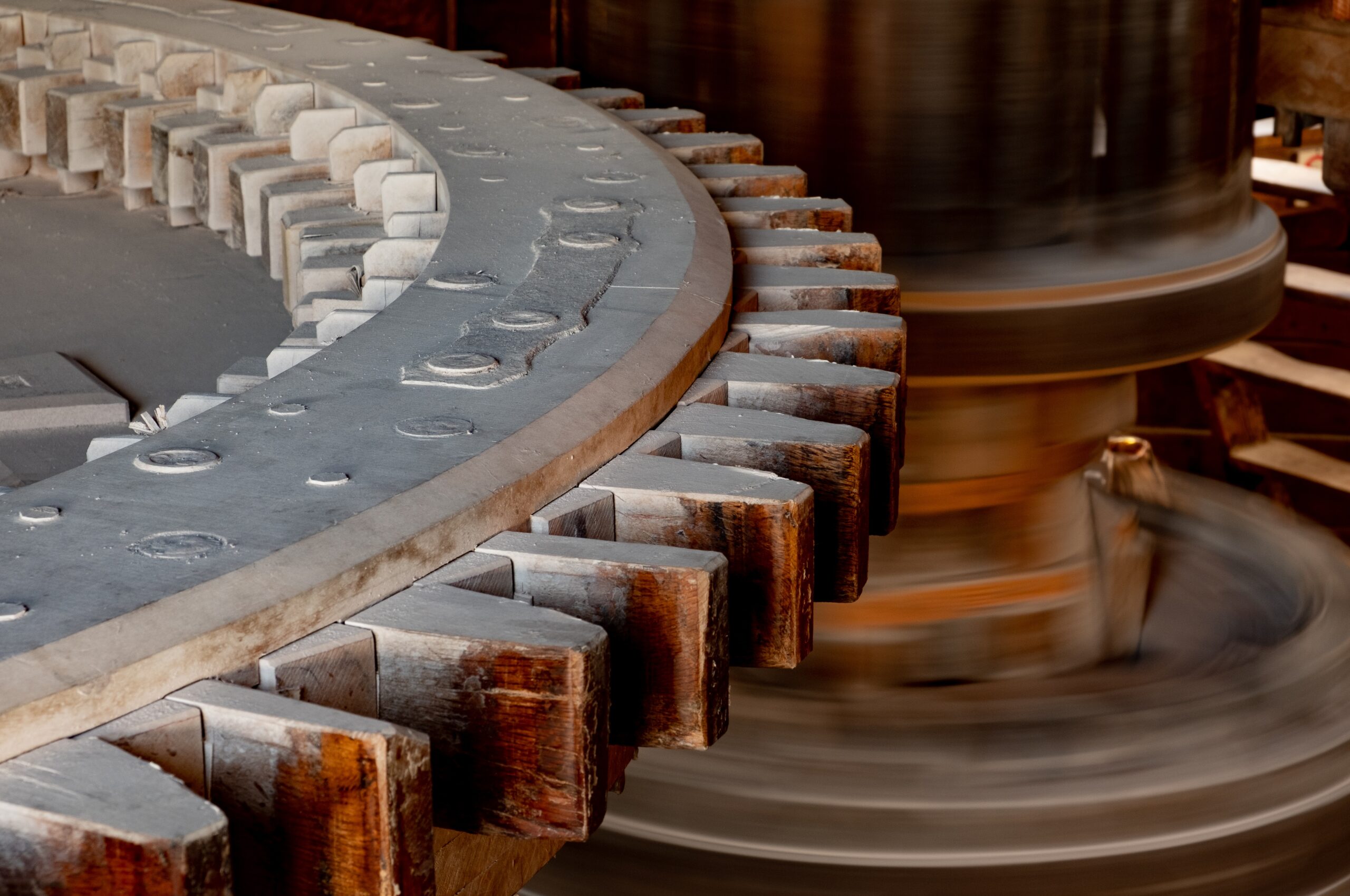

Gears appear to be shifting. How did last week’s news help change gears on the conversation?

Monday S&P 500 1.43% | NASDAQ 1.26%

Markets opened the week red hot as all were looking ahead to inflation data due out Tuesday. Weaker expectations around inflation led to speculation around a shorter horizon to peak rates from the Federal Reserve Board (FRB). Markets were pricing in a terminal rate (the highest rate the FRB will execute on) at 4.5%.

Tuesday S&P 500 0.73% | NASDAQ 1.01%

CPI data was weaker than expected. This was great news for the markets as weaker inflation signals potential for a more dovish FRB. Markets opened like a rocket ship rising over 3%, they then came back to earth closing up about 1%. The move lower was cautious optimism about the FRB meeting already underway.

Wednesday S&P 500 0.61% | NASDAQ 0.76%

Markets were up most of the day in anticipation of a more dovish FRB. They got the slower rate increase they expected, but it came with jaw boning that was decidedly more hawkish. That reset expectations for the next few hikes and the terminal point for hikes. The FRB clearly feels like looser financial conditions (stronger stock performance) can contribute to a rebound of inflation. They are doing what they can to keep market sentiment suppressed.

Thursday S&P 500 2.49% | NASDAQ 3.23%

If the FRB wanted tighter financial conditions, well they are getting them. The markets dove Thursday as three additional central banks raised rates and came through hawkish. Additionally, retail sales came through weaker than expected. The selloff reflected stress around FRB activity going too far, leaving too little room for a soft landing. The FRB updated their terminal rate expectation from 4.6% to 5.1%. As that data moved, so did markets and not for the better.

Friday S&P 500 1.11% | NASDAQ 0.97%

Friday continued the barrage of weaker US economic data. PMI data for both manufacturing and services showed weakness, slipping into contractionary territory. Further feeding the fears of a recession in coming months. Initial projections by the Atlanta FRB had Q4 growing by 4.9%. That number has now retreated to 2.8%. This is still growth, but far weaker than expected for the strongest quarter of the year.

Conclusion S&P 500 2.09% | NASDAQ 2.72%

The FRB press conference on Wednesday made people forget quickly the positive CPI readings from Tuesday. It led the markets lower for three straight days and for the second week in a row. There appears to be a shift in focus as the FRB anticipates taking less action in the future. The tone appears to be moving away from rate hikes and towards what seems to be an inevitable recession. The damage of 9 months of hikes that saw the Fed Funds Rate rise to 4.5% are taking their toll. We still have some time before we will see the impact on employment pick up. We will likely already be in a recession by the time that lagging indicator makes itself apparent.

~ Your Future… Our Services… Together! ~

Your interest in our articles helps us reach more people. To show your appreciation for this post, please “like” the article on one of the links below:

FOR MORE INFORMATION:

If you would like to receive this weekly article and other timely information follow us, here.

Always remember that while this is a week in review, this does not trigger or relate to trading activity on your account with Financial Future Services. Broad diversification across several asset classes with a long-term holding strategy is the best strategy in any market environment.

Any and all third-party posts or responses to this blog do not reflect the views of the firm and have not been reviewed by the firm for completeness or accuracy.