02|22|2023

Heart Stopper? | February 17, 2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, CPI, FRB, Retail Sales No heart stoppers this last week as markets...

02|22|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, CPI, FRB, Retail Sales No heart stoppers this last week as markets...

02|21|2023

AUTHOR: Kerry Hilsabeck, CFP® TITLE: Investment Adviser Rep TAGS: Jobs, CPI, PPI, Retail Sales, Housing, Yield Curve, S&P 500 Highlights from the February 17, 2023 Leading Indicator Watch: Retail...

01|17|2023

AUTHOR: Kerry Hilsabeck, CFP® TITLE: Investment Adviser Rep TAGS: Jobs, CPI, Yield Curve, S&P 500, Consumer Sentiment Highlights from the January 13, 2023 Leading Indicator Watch: The S&P 500...

12|20|2022

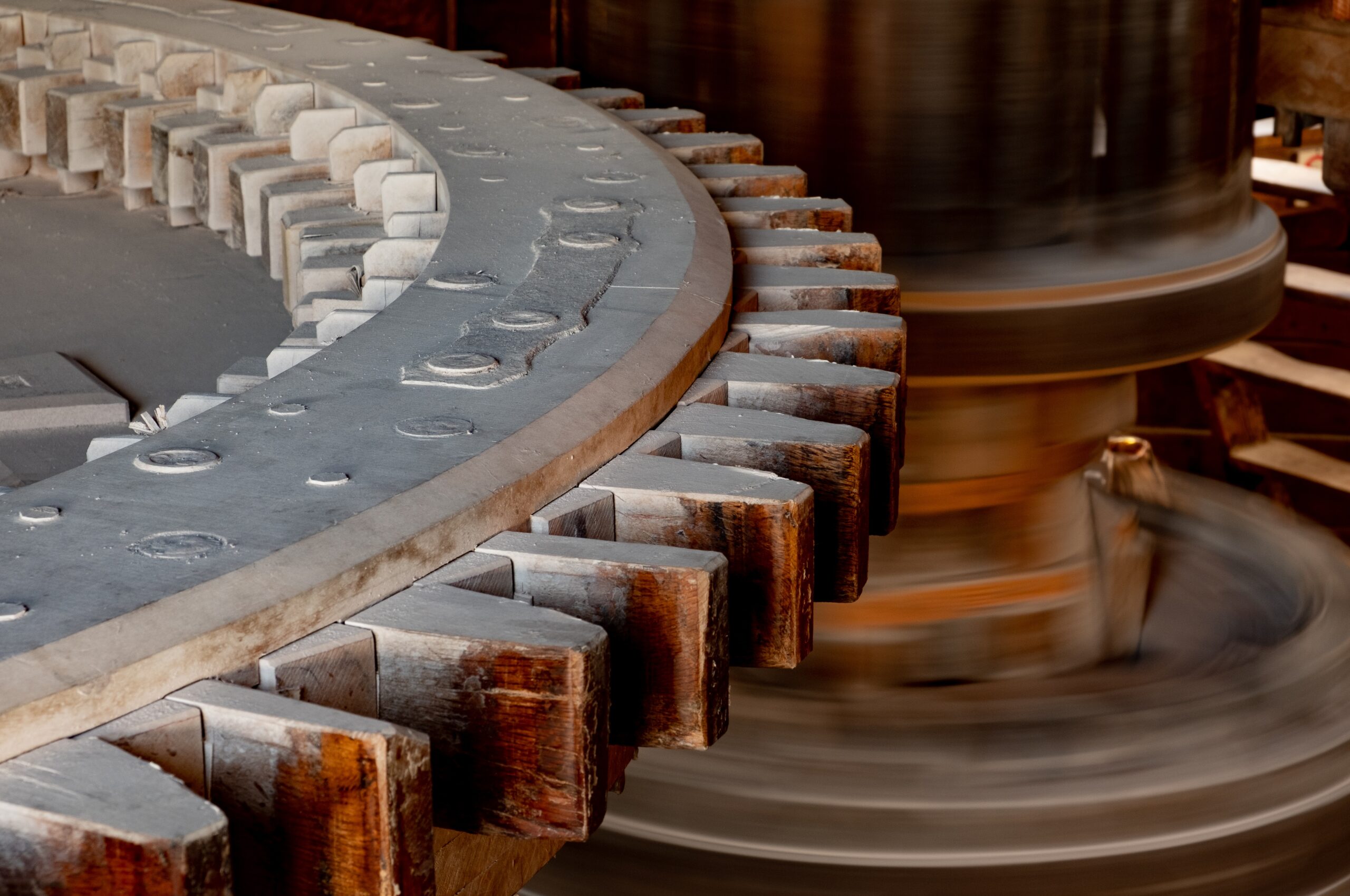

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, CPI, FRB, Rates Gears appear to be shifting. How did last week’s...

12|19|2022

AUTHOR: Kerry Hilsabeck, CFP® TITLE: Investment Adviser Rep TAGS: Jobs, CPI, Retail Sales, Yield Curve, Manufacturing Services, S&P 500 Highlights from the December 16, 2022 Leading Indicator Watch: Preliminary...

12|13|2022

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, Rates, FRB, CPI Markets looked ahead and did not like their chances...

11|14|2022

AUTHOR: Kerry Hilsabeck, CFP® TITLE: Investment Adviser Rep TAGS: Jobs, CPI, Yields, S&P 500, Consumer Sentiment Highlights from the November 11, 2022 Leading Indicator Watch: The S&P 500 rose...

09|20|2022

We saw another route last week as economic data strengthened. What does it mean for the road ahead? Monday S&P 500 1.06% | NASDAQ 1.27% Markets opened the week...

09|19|2022

Highlights from the September 16, 2022 Leading Indicator Watch: Core CPI rose .6% (MoM)(Aug) rising above forecasts of .3%. The Fed will likely announce another large rate hike in...

07|19|2022

Things were bumpy last week. Did that give us any indication of how things will go in the coming weeks? Monday S&P 500 1.14% | NASDAQ 2.24% The...