03|04|2026

Monthly Market Monitor | February – 2026

It was a wild ride on the monitor last month. How have Markets Shifted? Fixed Income: 2-Yr Treas Yield 3.38% | 10-Yr Treas. Yield 3.97% Yields across the curve,...

03|04|2026

It was a wild ride on the monitor last month. How have Markets Shifted? Fixed Income: 2-Yr Treas Yield 3.38% | 10-Yr Treas. Yield 3.97% Yields across the curve,...

03|03|2026

Bond yields fell last week as major equity benchmarks slipped. Will March steady markets after a short, but not-so-sweet, February? Monday S&P 500 1.04% | NASDAQ 1.13% All major...

03|02|2026

Consumer Goods & Materials: Producer price index (PPI) rose 0.5% in January (MoM), up from 0.4% in December and higher than forecast. Rising wholesale prices are an early signal...

02|24|2026

Markets climbed higher this week following President’s Day. Will markets continue to balance risk-on assets in the changing landscape? Monday S&P 500 0.00% | NASDAQ 0.00% Markets Closed in...

02|23|2026

Consumer Goods & Materials: Core Personal Consumption Expenditure (PCE) price index rose 0.4% in January, up from 0.2% in December and higher than forecast. The annual measure increased 3.0%....

02|17|2026

This week was a lot of tough love for the technology sector. Will gains continue to be made elsewhere? Monday S&P 500 0.47% | NASDAQ 0.90% Momentum built to...

02|16|2026

This week all eyes were on Consumer Goods & Materials. Consumer Price Index (CPI) rose 0.2% in January, down from 0.3% in the previous month. The annual measure increased...

02|10|2026

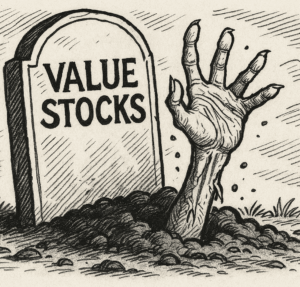

A rollercoaster week for equities but volatility did fade. Will leadership continue in value stocks as growth is under the microscope? Monday S&P 500 0.54% | NASDAQ 0.56% The...

02|10|2026

Unemployment: Jobs data were front and center this week. Initial Jobless Claims jumped from 209K to 231K. Continuing Jobless Claims rose from 1,819K to 1,844K. JOLTS Job Openings dropped...

02|06|2026

Markets were little changed last month. But a quick look at the monitor shows us that there may be a changing of the guard… Fixed Income: 2-Yr Treas Yield...