02|22|2023

Heart Stopper? | February 17, 2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, CPI, FRB, Retail Sales No heart stoppers this last week as markets...

02|22|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, CPI, FRB, Retail Sales No heart stoppers this last week as markets...

02|14|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, FRB, Oil, Earnings, Sentiment Markets pulled back this last week. What could...

02|07|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, FRB, Rates, Jobs, PMI While the Fed was the headliner, the Jobs...

01|31|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, GDP, PCE, PMI, Earnings Markets surged as earnings season rolled on last...

01|24|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, Financials, Homes, Jobs Stocks ended mixed last week. Are stocks making the...

01|18|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, Inflation, Consumer Sentiment Inflation fell for the fifth month in a row...

01|10|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, Manufacturing, PMI, FRB, Jobs The year opened in the green. Should our...

01|04|2023

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, Tech, Oil, Year end The weeks end and the years end both...

12|28|2022

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, Housing, BOJ, PCE The S&P 500 was flat last week. Is this...

12|20|2022

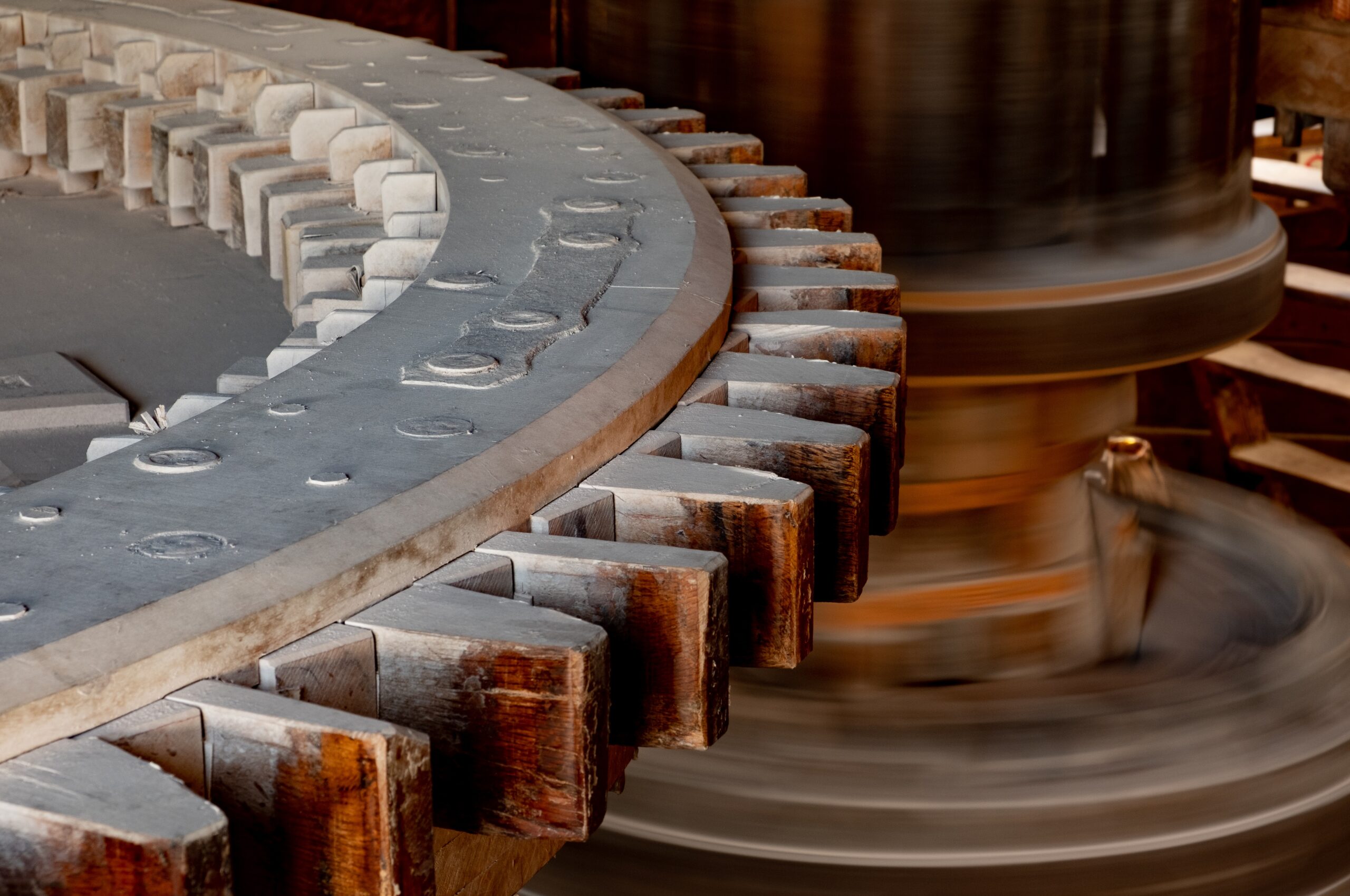

AUTHOR: Jason Roque, MS, CFP®, APMA®, AWMA® TITLE: Investment Adviser Rep – CCO TAGS: S&P 500, NASDAQ, CPI, FRB, Rates Gears appear to be shifting. How did last week’s...